I’ve been invited to contribute to a couple of panel sessions at this year’s IBM Think Summit in London, one of which is titled “All for tech and tech for all!”. The Alexander Dumas influence got me looking up his various quotations which led me to something which is very apt for the event:

“One’s work may be finished someday, but one’s education never.”

The Think event is always thought provoking and a great place to learn, with top notch speakers, challenging ideas and great content, from keynotes to debates to customers to more detailed sessions. This year it has moved from the Truman Brewery to Olympia London, so there will be less stairs, doors and dark corners to navigate, but it means the event can spread out with a new campus style. I started writing this post on the day of the Global climate strike and it’s no surprise that this year’s Summit has a focus on sustainability, with Hugh Fearnley-Whittingstall delivering the first guest keynote after Bill Kelleher, IBM’s Chief Executive in the UK, opens the show in the morning.

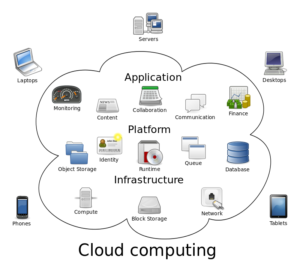

As well as two streams of content in the Showcase theatres, 3 streams of workshops for developers, a stream of lively debates (more on that later), there is a series of fast paced 15 minute sessions in the Think Tanks. Those short talks are in varied formats covering cloud, infrastructure, security, resilience, data, AI and shaping the future.

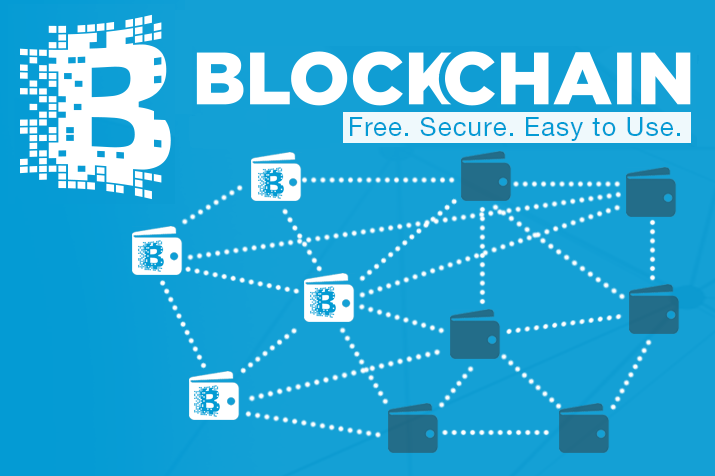

Topics like Quantum Computing, Advanced AI and Blockchain will get a lot of attention. As well as the talks, debates and workshops, there will be four Campuses to explore which will host exciting experiences and engaging TED style talks sharing client stories:

- Cloud & Infrastructure

- Security & Resiliency

- Data & AI

- Shaping the Future

I’m particularly interested in the Cloud & Infrastructure campus as this will be the first Think Summit following the finalisation of IBM’s acquisition of Red Hat. As you may know, I’ve written about the significance of this move, with IBM positioning themselves, in my opinion, as the “Enterprise Cloud” company. IBM’s approach is truly hybrid and multicloud. Embracing Red Shift’s containerised OpenShift platform means you can build your codebase once and deploy anywhere – on-premise, private cloud, public cloud or at the edge. With IoT and AI applications, edge computing, or moving servers to where the work happens because of latency issues, becomes a must. They will also be covering their integration approach, how you modernise existing and legacy applications, as well as their way of managing this multicloud environment cost effectively, safely and securely. They will cover the IBM Garage methodology with an experience showing how this approach helps you move faster, work smarter, and ideate more rapidly. They will cover a host of examples of IBM Cloud deployments across 20 different industries.

In the campus you’ll be able to get hands on with 4 activations:

- IBM Garage Accelerator – 3 short films demonstrate how clients have worked with IBM Garage to transform their businesses with the speed of a start-up, at the scale of an enterprise.

- IBM Garage Innovation Wall – Follow Mueller’s journey as they quickly define, test, and deploy a solution that changed the way their sales reps interacted with contractors, one of their primary end users.

- Customer Success Stories: Explore 15 cross-industry stories of client achievements of accelerated transformation based on IBM Cloud and Infrastructure (apparently this will be sushi bar style – can’t wait!).

- Drive Race Winning Innovation with Red Bull Racing Playseats – there’s even a competition to win a factory tour at Red Bull Racing HQ.

On top of that they’ll be 6 demo pods, 10 business partners to meet, and 13 TED talks going on. I haven’t got space for the other 3 campuses, but they’ll be just as comprehensive, so there will be lots to learn and a lot of ground to cover.

Now to the Debates, moderated by Katie Derham. I’m assuming they will be “in the round” like last year, and under the Chatham House Rule, so for a change I won’t be tweeting every other second. IBM wants open, thought provoking, maybe even controversial debates so people can really speak their mind. I’ll be contributing to two:

All for tech and tech for all

Over the past twenty years we have seen technology become fully embedded in our daily lives, and increasingly embraced across all age groups. With an eye firmly on the future, IBM are bringing together a panel of younger and older people, to discuss where technology is heading, what problems it could solve, how it is developed and marketed and how it will be used. How should technology address the needs of the different generations in our society moving forwards, and what will need to change, so that we are truly living in an age of “All for Tech and Tech for All”? I plan to talk about the difficulty in predicting the future, how tech could be our saviour, definitely something on creativity, and maybe something on how we aren’t educating the current generation properly for what happens next. What sort of tech might we talk about? Designer antibiotics, ingestible robots, smart clothing, photonics?

Essential Education

The world we work in is changing – and changing rapidly. For those with the right skill-sets, new opportunities abound, and new, challenging careers await; we have the some knotty problems to address – and need a innovative, creative, workforce to address them. But with the pace of change fast and relentless, how do we ensure today’s youth are prepared for the work of tomorrow – and not left behind? How might we promote life-long learning in order to capitalise on a wealth of experience and knowledge? Technology is undoubtedly driving force behind the revolution – but how can education be used to harness that power for good? I just might mention the most watched TED Talk ever (62 million views and counting). That’s Sir Ken Robinson brilliant summary of his “Out of our Minds” book in 18 minutes (highly recommended, both book and talk). We need to change the structure and priorities of a 19th century designed education system to make it fit for the 21st century. We need to get creative. And lifelong learning is a must. Come along and join in the debates!

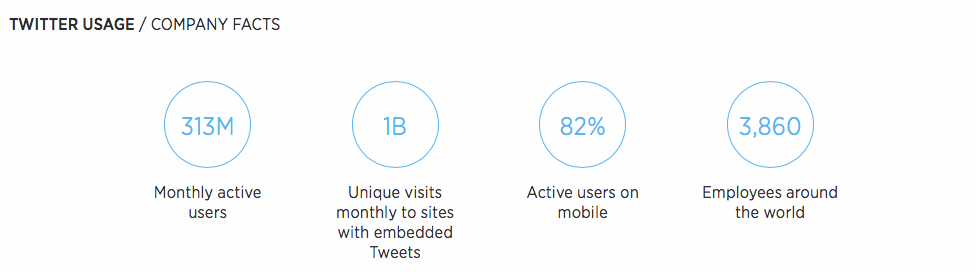

As I finish this post, IBM Think Summit London is only 20 days away. It’s shaping up to be quite something. Check out the agenda, and please make time and register to attend right now! It would be great to meet you at Olympia London, and if you’ve got any questions or suggestions in advance, don’t hesitate to contact me or find me on Twitter. See you there!

I mentioned above that I

I mentioned above that I