Earlier this month we lost a friend and the world lost a super-smart, clear thinker and business innovator. Our friend Sigurd Rinde, business partner, fellow Enterprise Irregular and founder of Thingamy, died peacefully at home with his family on 9th May 2019. This post isn’t intended to be a eulogy or an obituary, but a reminder of some of the important ideas that Sig taught us, and which will continue to influence our thinking on how business is done and the future of work.

One of the phrases you would often hear Sig say was:

“Management isn’t working!”

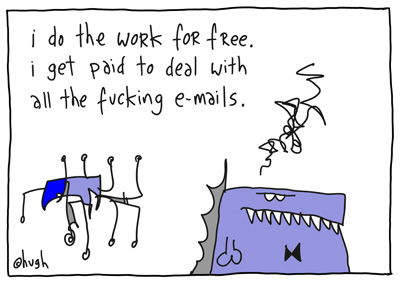

He was scathing about the “business as usual” attitude of all levels of management in our enterprises, the rigidity of the business systems that most organisations use, and the amount of time the average knowledge worker spends in meetings, dealing with their inbox and looking for answers. Sig was, like me, a big fan of Gapingvoid cartoonist Hugh Macleod:

Sig was always critical of the concept of ERP (Enterprise Resource Planning). In fact, he redefined the term as Easily Repeatable Processes describing them on his blog as:

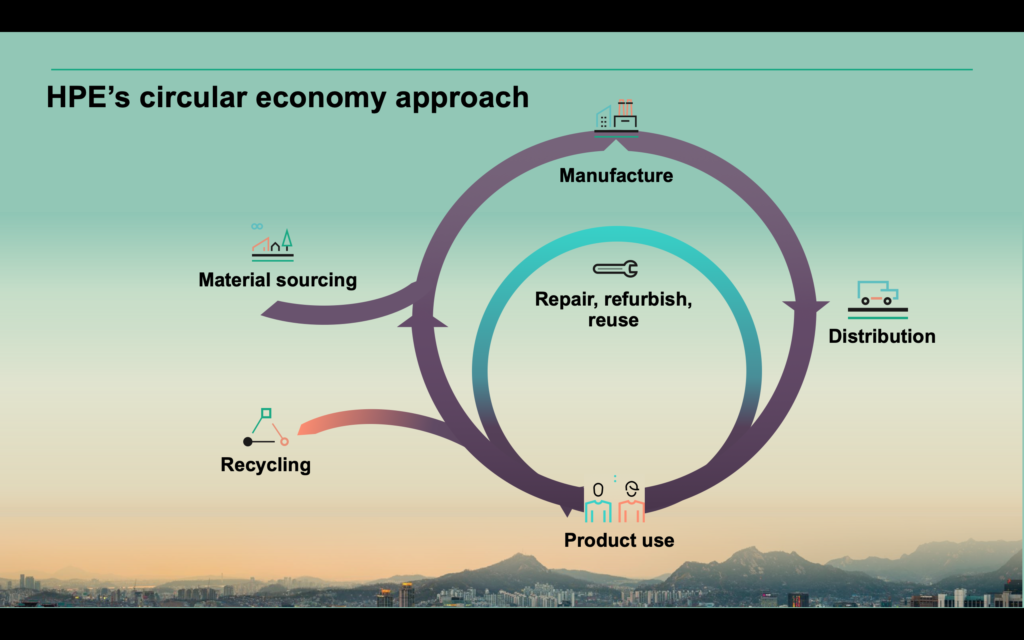

“Processes that handles resources, from human (hiring, firing, payroll and more) to parts and products through supply chains, distribution and production. The IT systems go under catchy names like ERP, SCM, PLM, SRM, CRM and the biggest players are as we know SAP and Oracle plus a long roster of smaller firms.”

So most organisations large, medium or small may have a company wide IT system which is either an integrated package, or assembled from best of breed components covering the very structured processes and data models required by their particular industry sector for order processing, finance, corporate planning, manufacturing or project management, procurement, sales and various forms of relationship management. The problem is that these systems almost certainly don’t cover all of the processes needed and they certainly don’t cover the way things actually happen day to day. For that reality, Sig coined the term Barely Repeatable Processes (BRP).

Barely Repeatable Processes (BRP)

There are plenty of ad-hoc processes in any company. They might cover the unplanned issues that happen every day, or they are the company specific things that aren’t covered by the standard package. They might have no system to help at all, or are often supported by data in an Excel spreadsheet being e-mailed around a group of people. These are what Sig calls Barely Repeatable Processes (BRP). They have some rules, but they often need to adapt and change as new circumstances arise. They need information, but it’s often unstructured notes and facts captured on paper or buried in e-mails sitting in someone’s inbox on their PC, tablet or smartphone.

Sig founded his company and product, Thingamy, to address that business challenge. His business philosophy was rooted in value creation, and a desire to shift the balance of work to effectiveness (doing the right things) over efficiency (doing things right). He recognised that the big opportunity to do better was with our knowledge workers:

“This is the big but forgotten area of opportunity. Knowledge work happens mostly in non-linear, unpredictable processes/flows, a kind of process where about 63% of the world’s value creation happens. At the same time these kind of processes have only manual support – organisational hierarchies and management – that costs approximately 2/3rd of a knowledge worker’s time.”

All work is a flow

Business is all about getting the work done and the work is a flow. We discussed ERP and email and the imperfect systems we have to deal with. To help get things done we’ve tried to bridge across our data and application silos by adding enterprise social networks like Jive, or by using Office365 with Yammer and Teams, or by adding external collaboration tools like Slack. All this means the digital workplace is getting more complex, and there has to be a better way to approach the problem.

Getting work done is where the value gets created. This core purpose of any organisation generates a sequence of activities – a flow. Like water it requires a framework to be useful. Now there are three basic ways you can move water around:

- In pipes – that’s the industrial approach, creating a complex system of flows with fixed connections, joints and valves, and more pipes to connect to the next system – like too much of the business application software and ERP systems we talked about above.

- In buckets passed hand to hand – how much of our day to day work feels like that, with work slopping over the edges on to the floor and not getting to where it needs to be?

- Along a riverbed – water finds its path – there may be rocks, branches and obstructions that change the flow, but water finds it way around them, and we can work on the riverbed to remove the obstructions, or the river banks to shorten the course.

Ignore the pipes and buckets, we need work to flow. If you start to think about work in this way, you recognise that you need to shift the balance of your thinking to more organic terms like river management or gardening, over systems thinking like an engineer. We should be thinking about flexible and adaptable frameworks that follow the riverbed model to help work find its path and so make the value flow more effectively. This thinking dovetails perfectly with our contention that all businesses need to be thinking of themselves as being in a permanent state of reinvention to fight off their competitors. Adaptability is the key survival trait in today’s business environment, and that adaptability characteristic, handling the exceptions over the rules, needs to be designed in to the apps and business systems that support the way we work. Thanks Sig.

If you want to talk about Sig, find out more about these ideas, or how this kind of framework can help your transformation project, then please contact us.